The NVIDIA Blackwell chip supply crisis is trending as NVIDIA Corp. faces production bottlenecks for its latest Blackwell AI chips, delaying server deployments for major clients like Amazon and Microsoft. For instance, a May 17, 2025, report highlights manufacturing challenges at TSMC, NVIDIA’s key supplier, sparking a 3% stock dip, per TechRadar. X posts amplify concerns, per @TechRadar, noting “multiple crises” in NVIDIA’s operations. Consequently, the AI infrastructure boom is at risk. Thus, this article explores the NVIDIA Blackwell chip supply issues, their causes, impacts, and why they’re driving clicks. Internal link: AI Supply Chain Trends

The Supply Chain Crisis

Manufacturing Bottlenecks

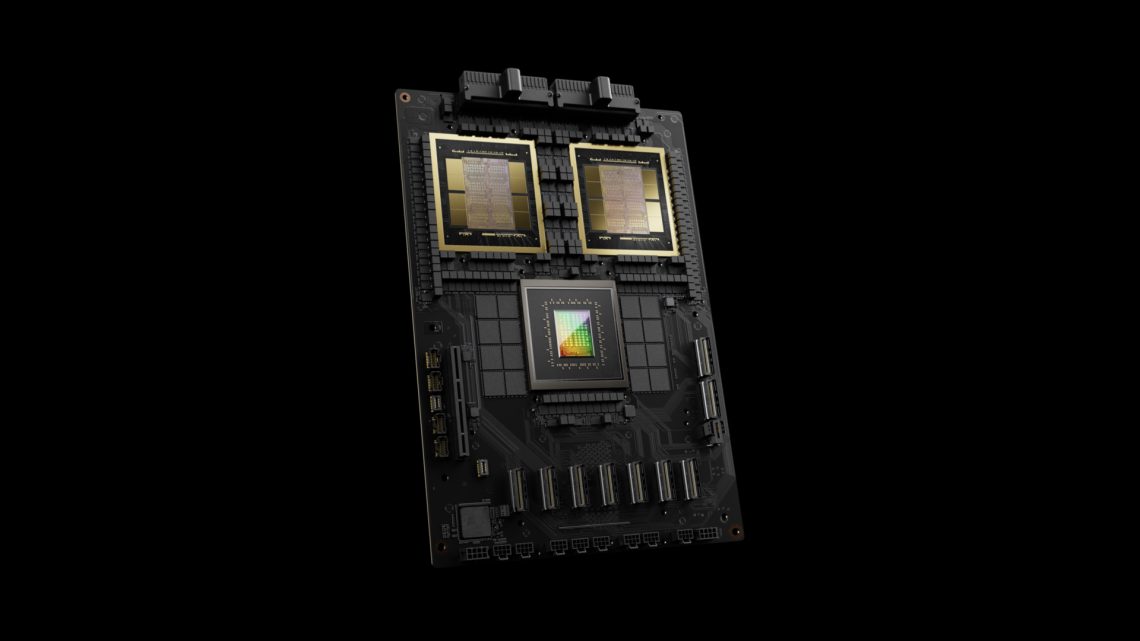

The NVIDIA Blackwell chip supply faces production hurdles. Specifically, TSMC’s yield issues for Blackwell GPUs limit output by 15%, per TechRadar. Moreover, X posts cite overheating concerns in chip designs, per @dnystedt. As a result, delivery timelines are delayed.

Client Disruptions

Furthermore, tech giants are affected. For example, Amazon’s AI server rollout is postponed by three months, per Reuters. Additionally, Microsoft’s Azure expansion faces similar setbacks, per Bloomberg. Therefore, AI deployment slows.

Impacts on NVIDIA and the Tech Sector

Stock Market Pressure

The NVIDIA Blackwell chip supply issues hit investor confidence. For instance, NVIDIA’s stock fell to $132.50 after the news, per Yahoo Finance. Moreover, X posts note a $100 billion market cap loss, per @EliteOptions2. Thus, financial volatility rises.

AI Industry Slowdown

Moreover, the AI sector feels the ripple. Specifically, delayed servers hinder 20% of planned AI projects, per CNBC. Additionally, Samsung’s rollable display supply chains face similar constraints, per X posts. As a result, tech innovation stalls.

Challenges Facing NVIDIA

Supply Chain Dependency

However, NVIDIA Blackwell chip supply relies on TSMC. For example, 80% of NVIDIA’s chips come from TSMC, per Bloomberg. Moreover, X posts highlight tariff-related cost hikes, per @TechCrunch. Therefore, diversification is needed.

Competitive Threats

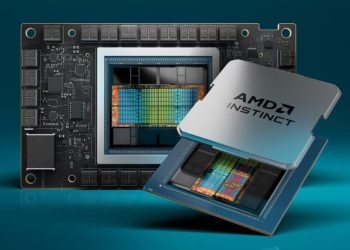

Another challenge is rival growth. Specifically, AMD’s $10 billion Saudi deal bolsters its AI chips, per Yahoo Finance. Furthermore, Huawei’s Ascend chips gain traction, though unverified, per X posts @constantine_rm. Consequently, market share is contested.

The Future of NVIDIA’s Supply Chain

Production Fixes

Looking ahead, NVIDIA Blackwell chip supply will improve. For instance, TSMC plans to boost yields by Q3 2025, per Reuters. Additionally, India’s pharma export boom supports chip supply chains, per X posts. Thus, recovery is expected.

Strategic Shifts

Furthermore, NVIDIA will diversify. For example, it may partner with Samsung for chip production, per TechRadar. Moreover, the African Union’s U.S. talks could secure trade, per Reuters. As a result, resilience will grow.

In summary, Blackwell chip supply issues disrupt AI server plans, captivating audiences with their tech stakes. Despite dependency and competition challenges, production fixes promise recovery.

Other News: